Recently, a Fixed Operations Director contacted me for advice, stating that his service department had a record month in labor gross profit but was unable to make a profit in the department. I requested a copy of his financial statement to investigate. Upon dissection, I discovered that the expenses as a percent of labor gross profit were as follows:

- Personnel Expense – 64.6%

- Operating/Semi-Fixed Expense – 30.6%

- Fixed Expense – 15.4%

- Total Expense – 110.6%

The operating expense was slightly higher than the year-to-date normal due to increases in advertising and a larger increase in policy due to a major repair that they had written off as a “customer goodwill” adjustment, both not typical for this department.

The fixed expenses were consistent with the department’s year-to-date entries, drawing my attention to the personnel expense contributions.

Upon further investigation, I discovered that there was no entry for “Unapplied Labor” or Adjustment/Cost of Labor, unusual since this department employed several hourly technicians.

Unapplied labor is defined as wages paid to a technician who was on the clock but was unable to bill to a customer. For example, if you had a $20.00 an hour technician who clocked 40 hours but only produced 32 hours of billable labor, you would incur 8 hours of unapplied time or $160.00.

I asked the Fixed Operations Director to forward a detail of the personnel expenses for the month. The compensation for the owner, supervisor, and clerical staff seemed appropriate for the department’s total labor gross profit; however, other wages and salaries were substantially higher than normal. I contacted their office manager for additional information.

The total service advisor’s compensation for the month was 12.5% of the total labor gross profit, which is very acceptable. This department has a dispatcher paid a salary of $7000.00 per month and a warranty administrator with a salary of $6000.00 per month. The remainder of the balance in this line was monies paid to technicians for production bonuses and unapplied labor.

The production bonuses that the Fixed Operations Director was paying were based on old targets established at new hire and were not adjusted as the technician’s skill levels improved, ultimately being paid out every month. This did not give the Director a “true” technician cost of sale and a “true” gross profit percentage of labor.

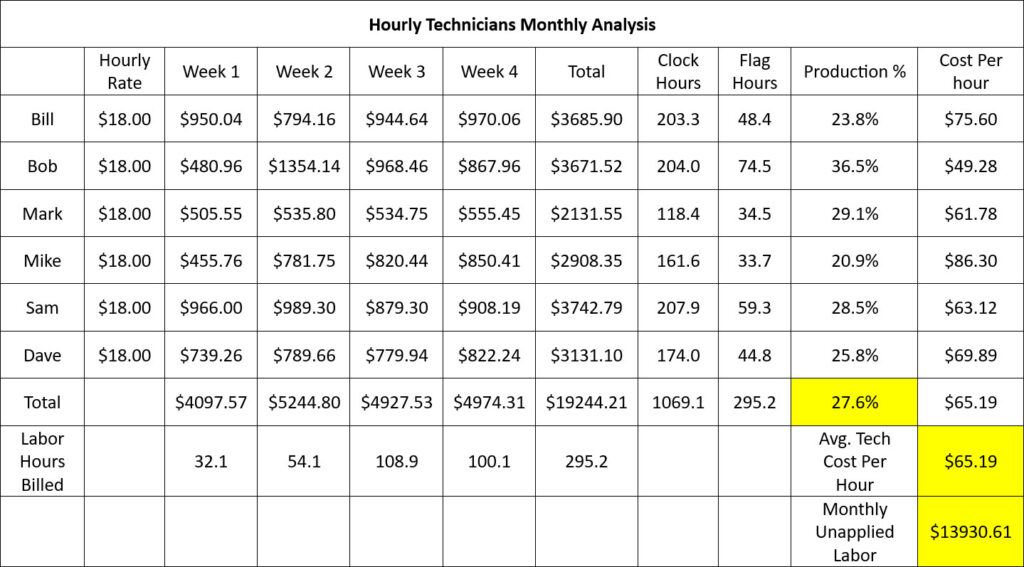

The remainder of the expenses were the true unapplied time adjustments lumped into the other wages and salaries line of the statement. I asked the Director if he was tracking the production of the hourly technicians and if he knew their true cost to produce an hour of labor. His reply was, “No, I do not.” Together, we built a spreadsheet so that we could accurately track, measure, and improve.

Example:

In the above example, we have determined the actual production of the hourly technicians along with the amount of money the office manager should post to unapplied labor: total compensation paid to the technicians minus the flagged hours multiplied by the technicians’ hourly rates, which are costed into the labor operations that they perform.

In this dealership, the Fixed Operations Director has chosen to re-evaluate each technician’s skill levels, abilities, production history, and the competitive market of wages, redetermine new hourly rates, and update production incentives. When a technician meets his or her monthly production objective, they will have earned the right to have the increase in hourly rate applied to the next month’s business, and the adjustment to the technician’s hourly rate can be applied in each labor operation they perform. This will provide the Fixed Operations Director with an actual gross profit percentage of labor.

By making these changes, he will be able to better control the true labor gross profit percentage, minimize the unapplied labor adjustments, measure hourly technicians’ production, and have a better incentive for production increase by the tenured technicians.

In closing, awareness and measurements of the entries to Service Department-Other Wages and Salaries can be a great resource for growing the bottom line on your statement.

Elevate your Fixed Operations department with our custom-tailored solutions. Our team offers in-depth assessments and specialized training programs, crafting strategies designed specifically to boost efficiency, maximize customer retention, and ensure long-term profitability. We’ll work closely with you to identify areas for improvement and implement targeted solutions that drive sustainable growth for your business.

Contact us today for a Free Consultation!